Buying a home for the first time can be a daunting task. Some folks are gifted the knowledge of how and what to do from their family or friends, others must seek out the info on their own. I believe that regardless of the situation, a few steps should be taken – before any houses are looked at!

Side note: I am not a financial professional, these are simply recommendations.

Try to have “life things” figured out. If you’ve come to the conclusion that owning a home is the next logical step in life, amazing! But – and this is a big but – make sure a few boxes are ticked before moving forward.

- Down payment. This could be zero down but is most commonly 3.5% to 20% of the purchase price.

- Fluff cash between $3,000 and $10,000. This will be mostly for the closing costs of the loan – the final amount being calculated by too many factors to name in this quick start guide. Cash also can be used for the inspection(s). It’s also nice to have a monetary buffer incase the house is perfect but needs some quick and easy updating!

- Monthly bills are minimized or zero’d out. On the fence about finally paying off your car or student loans? Do it before home shopping (without cutting into your down payment too much). Trust me.

- Credit Score. If it starts with a 4 or a 5, follow the prior bullet point and consult a credit specialist. It’s not the end of the world, but will gate keep the best rates and impact buying power.

- Couples: if the relationship is on the rocks, buying a house will not help!

- Xanax.. just kidding! Be prepared for things to go out of your control and be able to find your zen. Hopefully things go smoothly, but when purchasing real estate, there are simply too many variables.

Talk to an awesome Mortgage Officer. This person’s job is to keep their finger constantly on the pulse of the mortgage industry. Yes, your uncle Dave might have some staunch, yet financially sound, opinions for you to follow on your purchase, but the mortgage officer’s role is to verify the most up to date, cost effective way to meet your mortgage needs. Dated information on this constantly moving market can sometimes cost you a deal!

Get Prequalified. This will happen directly through your officer. A prequalifying letter is not the same as a pre-approval letter. Pre-qualification is a conversation between yourself and the officer: How is the credit? How is the income? Any skeletons in your financial closet? More often than not, after this conversation is had, and a pre-qualification letter is produced, you are free to go shopping.

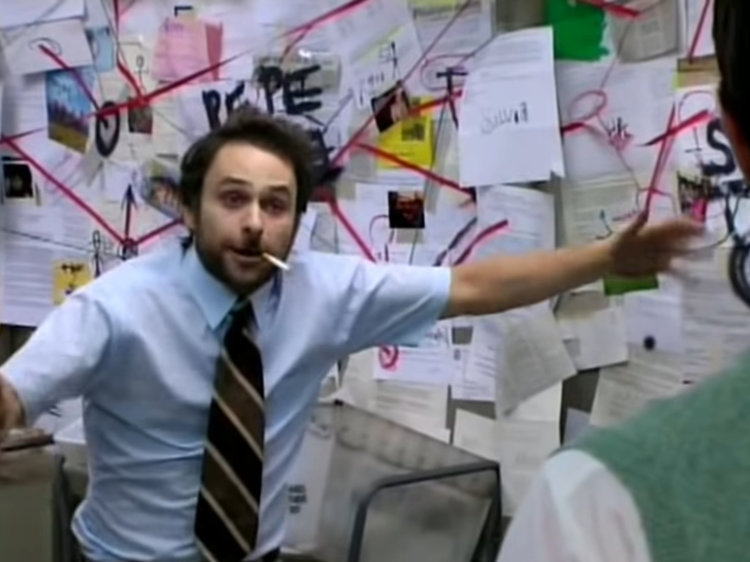

Now, where this gets sticky is with self employment or folks that may or may not have the best credit scores. Self employed, or 1099, clients must produce quite a few documents, bank records, etc etc. The list is different for each and every lender, but it can be quite extensive. It’s best to have all the boxes checked before going shopping for a home because underwriting the mortgage pre-approval takes significantly longer. Underwriting is the behind the scenes department at the bank that takes the stack of documents and put them into a giant equation machine (humans are heavily involved here too) to spit out the approval – see above image for reference.

Credit.. This one can be tricky but is relatively simple to understand: lower credit score, higher rate. Higher credit score, lower rate. Now, score is not the only factor here. Age of credit is important too. A 750 credit score from a forty year old client that’s had car loans, credit cards, mortgages, you name it, is not the same as a 750 score from a nineteen year old client with a Chase cash freedom card that they’ve had for two months.

Find a rockstar Realtor! If you have a friend, out of the blue, say, “you should work with this agent I know” then work with that agent. If you have a buddy that just became a Realtor, work with that agent. If you see an agent that has for sale signs in damn near every yard, work with that agent. If you find a Realtor with spectacular reviews online, work with that agent.

What I’m getting at is this: call a few agents and have a chat then follow your gut. You don’t need to be best friends with your Realtor to make it work, but you need to be able to get along and continue walking the path towards home ownership. I know from personal experience that sometimes personalities clash. There’s nothing anyone can do about it, things just happen! I also know that if a Realtor and client hit it off, buying a home can go from a good to great, very quickly. Plus, finding a rockstar Realtor will open up your network to finding other great professionals that will help get the job done!

Two things: Having a buyer’s agent does not cost the client any money (in 99.9% of transactions) because listing contracts have a total commission percentage built in that either goes goes all the way to the listing agent if there is no buyer’s agent or is split if there is a buyer’s agent. AND, don’t expect a Realtor to be perfect. Every agent has strengths and weaknesses.

Final take aways: Get your ducks in a row, get your head on straight, and find a great team of professionals to work with. Home ownership is a worthwhile journey that many folks on this planet will never have the privilege of experiencing so get out there and good luck!